The average homeowner spends $18,118 every year beyond their mortgage—costs that rarely appear in listings and only surface after closing. Nearly half of recent buyers report significant regret, primarily from expenses they never saw coming.

That charming colonial with "vintage character"? Its 40-year-old systems need replacement. The "move-in ready" ranch? Nobody mentioned the flood zone adding thousands to insurance. You can't budget for what listings deliberately hide.

The $9,000 Roof That Looked Perfect

Consider the Omaha property PropertyLens analyzed. Listed at $400,000, everything appeared well-maintained. But the 25-year-old roof in "good condition" raised immediate red flags. After enduring 30 severe weather events including 2.7-inch hail with 75% damage probability, that roof should have been destroyed. Yet no permits existed for replacement.

As PropertyLens co-founder John Siegman noted: "There's just no way that roof could be that good." The likely scenario? Unpermitted replacement after insurance claims—creating $9,100 in hidden costs plus potential insurance complications.

This pattern repeats nationwide. The Gulf Shores property with majestic oaks didn't disclose its FEMA flood zone status. The Scottsdale flip sat unsold for a year despite luxury finishes—hiding size discrepancies and undisclosed environmental risks. Each omission represents thousands in unexpected expenses.

When Risks Multiply Your Costs

According to CNBC's analysis of hidden homeownership costs, homeowners face $18,118 annually beyond mortgages, with maintenance the largest category. But property-specific risks multiply these baseline costs exponentially.

A home in a 500-year flood zone—which sellers aren't required to disclose—triggers cascading expenses:

- Flood insurance: $1,000-5,000 annually (not required but essential)

- Higher homeowners premiums: 15-30% increase for water risk

- Accelerated maintenance on foundations and systems

- Reduced buyer pool affecting resale value

PropertyLens data reveals how weather exposure compounds costs. Properties with significant hail history face insurance ranging from $2,900 to $10,000 annually—up to $833 monthly added to your payment. Add a probable roof replacement at $20,000-30,000, and that "affordable" home becomes a financial trap.

That charming colonial with "vintage character"? Its 40-year-old systems need replacement. The "move-in ready" ranch? Nobody mentioned the flood zone adding thousands to insurance. You can't budget for what listings deliberately hide.

The $9,000 Roof That Looked Perfect

Consider the Omaha property PropertyLens analyzed. Listed at $400,000, everything appeared well-maintained. But the 25-year-old roof in "good condition" raised immediate red flags. After enduring 30 severe weather events including 2.7-inch hail with 75% damage probability, that roof should have been destroyed. Yet no permits existed for replacement.

As PropertyLens co-founder John Siegman noted: "There's just no way that roof could be that good." The likely scenario? Unpermitted replacement after insurance claims—creating $9,100 in hidden costs plus potential insurance complications.

This pattern repeats nationwide. The Gulf Shores property with majestic oaks didn't disclose its FEMA flood zone status. The Scottsdale flip sat unsold for a year despite luxury finishes—hiding size discrepancies and undisclosed environmental risks. Each omission represents thousands in unexpected expenses.

When Risks Multiply Your Costs

According to CNBC's analysis of hidden homeownership costs, homeowners face $18,118 annually beyond mortgages, with maintenance the largest category. But property-specific risks multiply these baseline costs exponentially.

A home in a 500-year flood zone—which sellers aren't required to disclose—triggers cascading expenses:

- Flood insurance: $1,000-5,000 annually (not required but essential)

- Higher homeowners premiums: 15-30% increase for water risk

- Accelerated maintenance on foundations and systems

- Reduced buyer pool affecting resale value

PropertyLens data reveals how weather exposure compounds costs. Properties with significant hail history face insurance ranging from $2,900 to $10,000 annually—up to $833 monthly added to your payment. Add a probable roof replacement at $20,000-30,000, and that "affordable" home becomes a financial trap.

Nearly half of recent buyers report significant regret, primarily from expenses they never saw coming.

Your Pre-Offer Property Intelligence Checklist

Smart buyers gather systematic intelligence before viewing:

✓ Flood Zone Verification - Check FEMA flood maps. Even 500-year zones matter—PropertyLens helped a Houston buyer get flood insurance before their "safe" neighborhood flooded.

✓ Weather Event History - Properties with 30+ events face accelerated deterioration and insurance challenges

✓ Permit Verification - Unpermitted work creates insurance gaps and expensive remediation

✓ Environmental Screening - Radon, arsenic, mold risks that standard inspections miss

✓ True System Ages - Insurers refuse coverage for roofs over 20 years; four-point inspections reveal failing mechanicals

This represents hours of research—or minutes with a PropertyLens Home History Report aggregating all data points.

Converting Discovery to Negotiation Power

Pre-offer intelligence transforms real estate negotiations:

Traditional Approach: Make offer → Discover issues → Negotiate from weakness

Intelligence-First Strategy: Identify risks → Calculate costs → Negotiate from strength

A Boulder couple discovered multiple hail events requiring roof replacement. Armed with PropertyLens data, they secured $15,000 in credits. Another buyer discovered foundation issues before offering, walking away cleanly rather than after investing in appraisals.

Calculate Your True Monthly Housing Payment

The mortgage calculator lied. For a $350,000 home:

Fantasy Math:

$2,096/month (mortgage only)

Reality Check:

- Mortgage: $2,096

- Property taxes: $438

- Homeowners insurance: $125

- Maintenance reserve: $350

- Utilities: $200

- Actual: $3,209/month

High-Risk Property:

- Add weather-risk insurance: +$300

- Accelerated maintenance: +$200

- System replacements: +$250

- Risk-adjusted: $3,959/mont

That Omaha property? Insurance and taxes added $800 monthly—a third more than the mortgage. The "affordable" home costs nearly double the advertised payment.

Property Intelligence Technology Exposing Truth

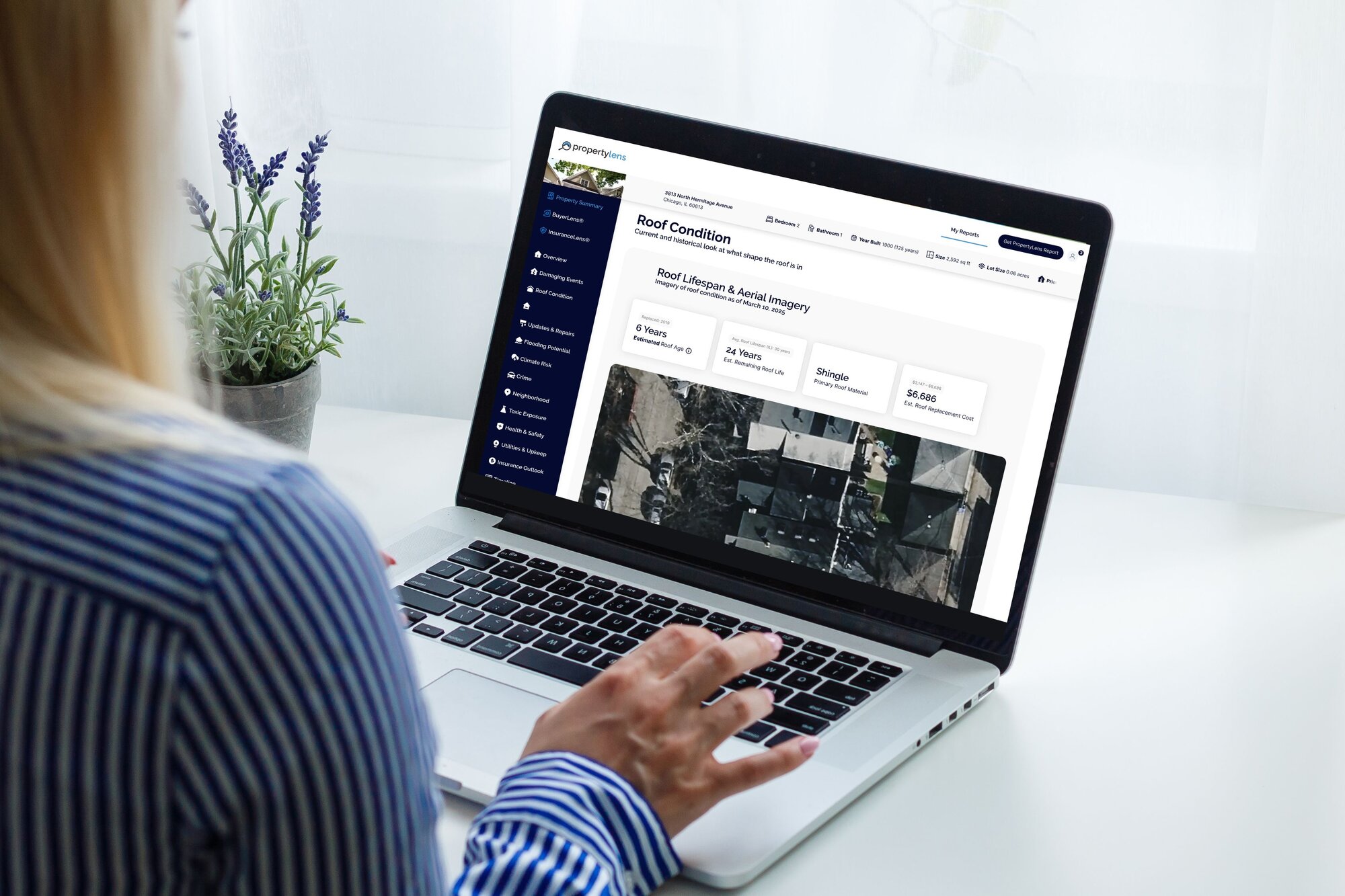

PropertyLens 2.0 aggregates 3.5 million damage records, 26 hazard categories, permit databases, and environmental monitoring. LensAI transforms this into personalized answers: "What will this really cost?"

This democratizes intelligence once exclusive to institutions. As PropertyLens reveals, 45% of homeowners regret their purchase due to surprise maintenance costs. These aren't actually surprises—they're selectively disclosed risks that PropertyLens surfaces before you commit.

Your Next Move: Get Property Intelligence Before You Offer

Millions make their largest purchase essentially blind, trusting curated listings and brief inspections. Nearly half end up with crushing regret about financial realities they never saw coming.

For $69—less than dinner—you can see what listings hide, understand risks in dollar terms, and negotiate from complete information. Smart buyers run PropertyLens reports before scheduling showings, asking better questions and avoiding expensive surprises.

The hidden costs aren't hidden—they're selectively disclosed. Insurance companies know. Sellers know. Only buyers are left in the dark.

Get your PropertyLens report today. Make your offer with confidence, not hope.

Because in real estate, what you don't know doesn't just hurt—it costs thousands.

About PropertyLens

PropertyLens delivers comprehensive property intelligence through AI-powered analysis of millions of data points. Our Home History & Risk Reports reveal hidden costs, unlisted risks, and critical property information that traditional inspections miss. Each report is backed by our money-back guarantee: if our intelligence doesn't help you make a better decision, we'll refund your purchase completely.

Smart buyers gather systematic intelligence before viewing:

✓ Flood Zone Verification - Check FEMA flood maps. Even 500-year zones matter—PropertyLens helped a Houston buyer get flood insurance before their "safe" neighborhood flooded.

✓ Weather Event History - Properties with 30+ events face accelerated deterioration and insurance challenges

✓ Permit Verification - Unpermitted work creates insurance gaps and expensive remediation

✓ Environmental Screening - Radon, arsenic, mold risks that standard inspections miss

✓ True System Ages - Insurers refuse coverage for roofs over 20 years; four-point inspections reveal failing mechanicals

This represents hours of research—or minutes with a PropertyLens Home History Report aggregating all data points.

Converting Discovery to Negotiation Power

Pre-offer intelligence transforms real estate negotiations:

Traditional Approach: Make offer → Discover issues → Negotiate from weakness

Intelligence-First Strategy: Identify risks → Calculate costs → Negotiate from strength

A Boulder couple discovered multiple hail events requiring roof replacement. Armed with PropertyLens data, they secured $15,000 in credits. Another buyer discovered foundation issues before offering, walking away cleanly rather than after investing in appraisals.

Calculate Your True Monthly Housing Payment

The mortgage calculator lied. For a $350,000 home:

Fantasy Math:

$2,096/month (mortgage only)

Reality Check:

- Mortgage: $2,096

- Property taxes: $438

- Homeowners insurance: $125

- Maintenance reserve: $350

- Utilities: $200

- Actual: $3,209/month

High-Risk Property:

- Add weather-risk insurance: +$300

- Accelerated maintenance: +$200

- System replacements: +$250

- Risk-adjusted: $3,959/mont

That Omaha property? Insurance and taxes added $800 monthly—a third more than the mortgage. The "affordable" home costs nearly double the advertised payment.

Property Intelligence Technology Exposing Truth

PropertyLens 2.0 aggregates 3.5 million damage records, 26 hazard categories, permit databases, and environmental monitoring. LensAI transforms this into personalized answers: "What will this really cost?"

This democratizes intelligence once exclusive to institutions. As PropertyLens reveals, 45% of homeowners regret their purchase due to surprise maintenance costs. These aren't actually surprises—they're selectively disclosed risks that PropertyLens surfaces before you commit.

Your Next Move: Get Property Intelligence Before You Offer

Millions make their largest purchase essentially blind, trusting curated listings and brief inspections. Nearly half end up with crushing regret about financial realities they never saw coming.

For $69—less than dinner—you can see what listings hide, understand risks in dollar terms, and negotiate from complete information. Smart buyers run PropertyLens reports before scheduling showings, asking better questions and avoiding expensive surprises.

The hidden costs aren't hidden—they're selectively disclosed. Insurance companies know. Sellers know. Only buyers are left in the dark.

Get your PropertyLens report today. Make your offer with confidence, not hope.

Because in real estate, what you don't know doesn't just hurt—it costs thousands.

About PropertyLens

PropertyLens delivers comprehensive property intelligence through AI-powered analysis of millions of data points. Our Home History & Risk Reports reveal hidden costs, unlisted risks, and critical property information that traditional inspections miss. Each report is backed by our money-back guarantee: if our intelligence doesn't help you make a better decision, we'll refund your purchase completely.

Key Features:

- PropertyLens 2.0: Next-generation risk analysis with 20+ data categories

- LensAI: Conversational intelligence answering your property questions

- PropertyInsite API: Institutional-grade data for partners and developers

- Two-Year Repair Forecast: Expected costs for your first 24 months

- Insurance Risk Assessment: Premium estimates based on actual property risks

Related Articles:

- Insurance Shock Is Redrawing Where Americans Can Afford to Buy

- What Your $2 Million Dream Home Might Be Hiding

- Buying in a Flood Zone: How to Spot Red Flags

- The True Cost of Home Ownership Calculator